cayman islands tax residency certificate

1 notarized documents and 2 documents signedissuedcertified by a Federal State County City University or School Official. In Paraguay an individual is deemed to be tax-resident if he or she spends more than 120 days a year in the country.

A Guide To The Benefits Of Cayman Islands Residency Investment Migration Insider

Form W-8IMY Certificate of Foreign Intermediary.

. Failure to file an ownership certificate. Original or Certified copy of Birth Certificate if applicable Evidence of Health Insurance. The MF Act requires that mutual funds falling within the above definition be registered or licensed with the Cayman Islands Monetary Authority CIMA under the MF Act in order to carry on business in or from the Cayman Islands.

Income Tax Filing. Tax residency days 180. The applicant must demonstrate that heshe had been a member of the religious denomination for at least 2 years preceding the application.

Luzon Visayas Islands and Mindanao. Provide your employer with a properly completed Form 8233 for the tax year. Application fee Applicants will need to pay both an application and a permit fee Total cost 1025 USD per.

SCO NO 247-248 FIRST FLOOR SECTOR 12 OPPOSITE MINI SECRETARIAT KARNAL HARYANA - 132001. For more information visit our Authentication. Documents pertaining to civil marital status or civil unity including marriage licenses or domestic partner registrations.

Capital Gains tax rate 10. The Act does not affect directors of other types of Cayman companies for example finance SPVs portfolio acquisition companies and other private holding or subsidiary companies which are not covered entities regulated by or registered with CIMA. Non-Immigrant E-1E-2 Visa Treaty TraderTreaty Investor.

Income tax under a tax treaty you may be able to eliminate or reduce the amount of tax withheld from your wages. From May 15 2019 the Consulate cannot authenticate the signatures on the following public documents. A new Tax Residency Self-Certification Form that establishes all of the accountholders residences for.

DHS Form DS-2019 Certificate of Eligibility for Exchange Visitor J-1 Status Court documents where the applicant is named as a party to the court proceeding. Employer is required to demonstrate that it has tax exemption status. As of 2019 there are an estimated 139 million green card holders of whom 91 million are eligible to become United States citizens.

A green card known officially as a permanent resident card is an identity document which shows that a person has permanent residency in the United States. Personal income tax rate 32. It is formed by an archipelago made up of 7107 islands divided in three islands groups.

Its the perfect zero-tax residency if you prefer European glamour to island living and youll be in the company of some of the wealthiest people on earth. Tuition fee scholarships living stipends and top-up scholarships are available to eligible researchers. If you want to become a Canadian citizen you must by law follow the Income Tax Act.

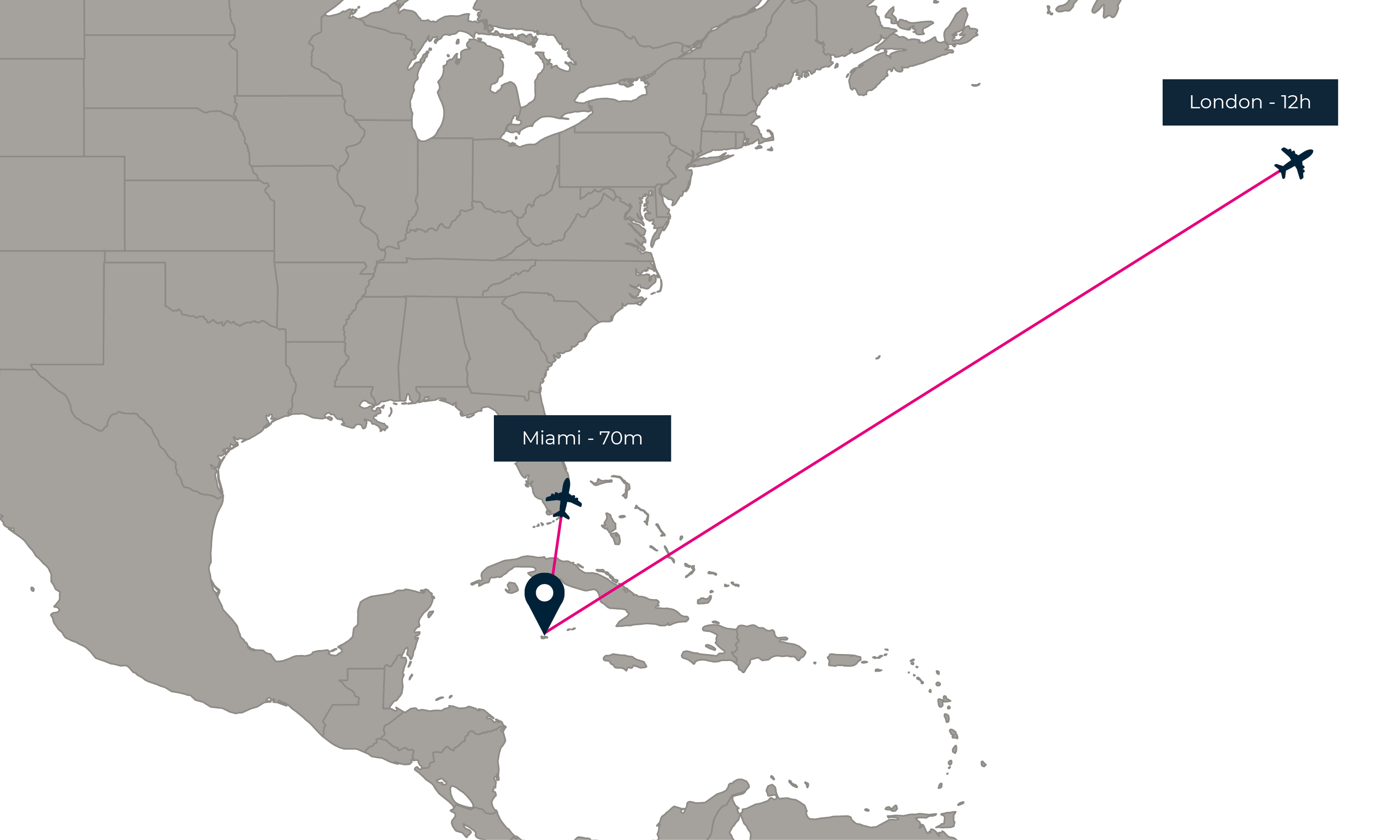

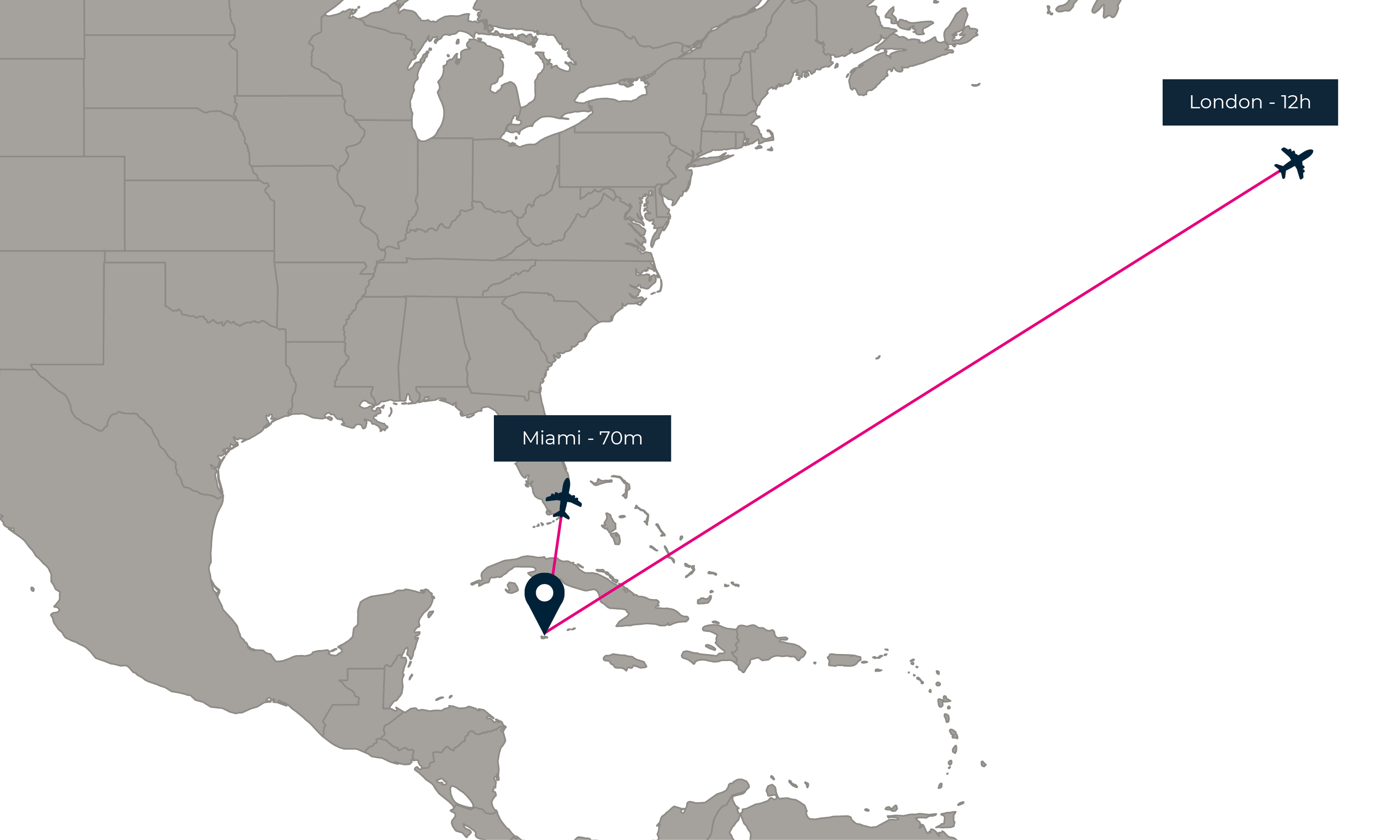

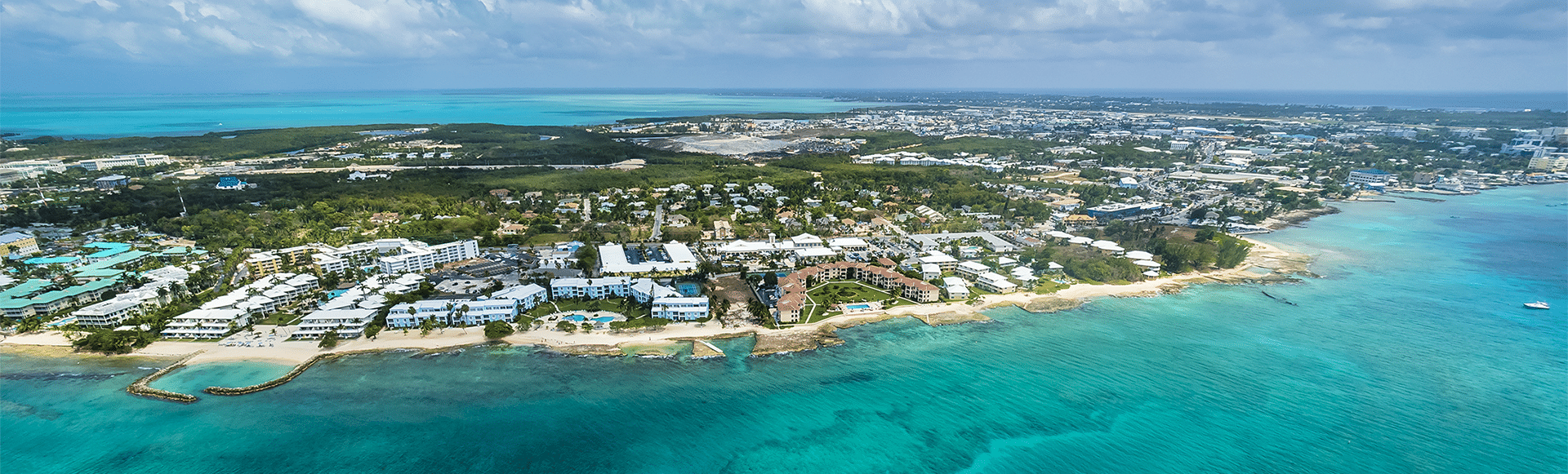

The Bahamas Extended Access Travel Stay is a one-year residency permit designed to allow digital nomads freelancers remote workers and students to work from any of the 16 tax-free amazing islands comprising The Bahamas. The Cayman Islands ˈ k eɪ m ən is a self-governing British Overseas Territory the largest by population in the western Caribbean SeaThe 264-square-kilometre 102-square-mile territory comprises the three islands of Grand Cayman Cayman Brac and Little Cayman which are located to the south of Cuba and northeast of Honduras between Jamaica and Mexicos. The Act applies to directors whether or not they are resident in the Cayman Islands.

The crown jewel of the Caribbean offshore world the Cayman Islands doesnt appeal to the middle class. Outside of marrying a local which still costs a 3150 fee you can receive a Permanent Residents Certificate which can require a period of prior residency up to 10 years and a 50000 fee. Both tax-residents and non-residents are subject to personal income tax on their Paraguayan-source income.

The CRA also applies a 50 penalty for each failure to fill out or to deliver an ownership certificate Form NR601 Non-Resident Ownership Certificate Withholding Tax and Form NR602 Non-Resident Ownership Certificate No Withholding Tax for the negotiating of bearer coupons or warrants. A vehicle with a single investor which. Join a project or propose your own to follow your passion for research.

If you wish to apply for citizenship you must first have permanent resident. Broadly that all revenue is taxable for the foreign entity and deductions are effectively incurred in the. Find out how to apply for a PHD MPhil or Postgraduate Doctorate scholarship at the University of Queensland in Brisbane Australia.

You can start a 100 foreign-owned company in the UAE. Initial admission is for 3 years with an extension of up to 2 years. My name is Marcos Kraemer.

Green card holders are formally known as lawful permanent residents LPRs. Personal income is taxed at 10 if income is equal to or higher than 120 monthly minimum salaries otherwise is taxed at 8. See our Briefing Note Establishing a Cayman Islands Closed-Ended Funds.

The change is due to the Philippines officially becoming a party to the Apostille Convention. State UT City Branch Revised Office Timing. If this applies to you you must meet your duties of income tax filing in four years normally 6 years before you apply for citizenship.

If you are not a student trainee teacher or researcher but you perform services as an employee and your pay is exempt from US. I am an attorney duly registered at the Attorneys Register List of the Supreme Court of Justice of Panama a member of the Panama National Bar Association the Inter-American Bar Associacion the American Immigration Lawyers Association the International Fiscal Association and the Association of European. However the taxpayers may opt to compare on a simplified basis the statutory CIT rate of the tax residency country of the foreign entity versus the corresponding Mexican CIT rate if certain requirements and characteristics are met eg.

How To Get Cayman Islands Residency And Pay Zero Tax

The Cayman Islands Residency By Investment Programme Latitude

The Cayman Islands Residency By Investment Programme Latitude

How To Get Cayman Islands Residency 7th Heaven Properties

The Cayman Islands Relocate Invest With Confidence Irg Cayman

Becoming A Cayman Resident The Cayman Islands

Discover An Easy New Way To Move To The Cayman Islands In 2022 Www Libertymundo Com

Resources For Global Investment And Immigration Uglobal

Cayman Islands Free Trade Zones Ultimate Guide Tetra Consultants

How To Get Cayman Islands Residency And Pay Zero Tax

A Guide To Exempted Company In Cayman Islands

Cayman Islands Residency Check Your Eligibility Today

Cost Of Living In The Cayman Islands Provenance Properties Provenance Properties

Cayman Islands Company Formations Vistra

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Residence By Investment Programs

How To Get Cayman Islands Residency And Pay Zero Tax

Cayman Islands Residency By Investment Tax Efficient Residency